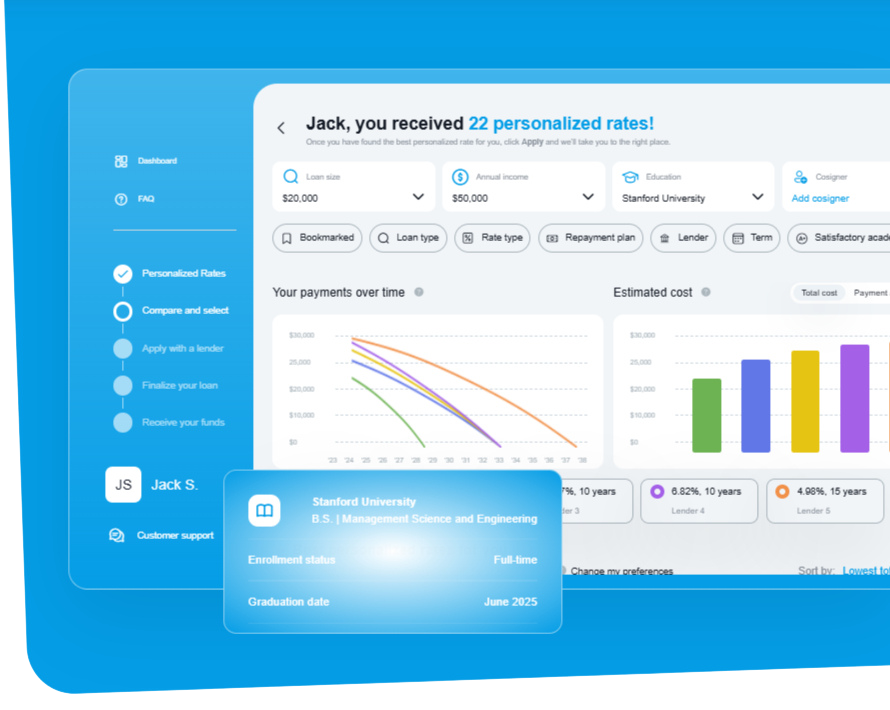

Automate your search for the best private student loans

Compare new, in-school student loans or student loan refinancing rates side-by-side from dozens of lenders without affecting your credit score. Simply choose your rate and apply.

FAQ

Who should consider a private student loan?

Private student loans are ideal for undergraduate or graduate students who need additional funds beyond federal aid. They’re especially helpful for students attending accredited colleges or universities who can qualify based on credit or have access to a creditworthy cosigner.

Who is eligible to refinance their student loans?

Refinancing is ideal for graduates with stable income and good credit. If you’re paying high interest rates on your current loans, refinancing may save you thousands over the life of your loan. Keep in mind: refinancing federal loans removes access to benefits like income-driven repayment and federal forgiveness programs.

How much does it cost to use Admire?

Nothing. We will never charge you to use the Admire site or any of the tools we offer.

Do I need a cosigner?

For private student loans, most undergraduate students will need a cosigner to qualify or to receive better rates. A cosigner is someone (usually a parent, guardian, or trust adult) with strong credit who agrees to share responsibility for the loan.

For student loan refinancing, a cosigner is not necessarily, but having a creditworthy cosigner can improve your chances of approval and help you qualify for a lower interest rate. Some lenders may require a cosigner if your income or credit profile doesn’t meet minimum criteria.

Does Admire pull my credit score?

Admire performs a soft credit pull in order to determine which lenders' products you might qualify for. A soft credit pull, unlike a hard credit pull, has no adverse effect on your credit score. It also allows us to provide the most accurate rates to you.

What information will I need to apply?

For private student loans, you'll typically need:

- School information

- Estimated cost of attendance

- Amount of aid received (grants, scholarships, federal loans)

- Social Security number

- Income and employment info (for you or your cosigner)

- Government-issued ID

For student loan refinancing, most lenders require:

- Government-issued ID

- Proof of income (pay stubs or tax returns)

- Loan payoff statements

- Proof of graduation (e.g., diploma or transcript)

Who is eligible to refinance their student loans?

Refinancing is ideal for graduates with stable income and good credit. If you’re paying high interest rates on your current loans, refinancing may save you thousands over the life of your loan. Keep in mind: refinancing federal loans removes access to benefits like income-driven repayment and federal forgiveness programs.

26

Student Loan

Programs

$1.6T

Student

Debt

5

Minute

Application

$$

Quick

Savings

No hidden fees, quick

savings!

All participating lenders offer a simple online application with zero origination fees or prepayment penalties. You can save thousands of dollars thanks to flexible terms and low fixed or variable interest rates. You're just one click away from finding the lowest rates around.